Invested!

Investing forms the overarching theme in my current life.

Hi, world! I am Hong, and today marks the inception of my blog. The motive behind this endeavor? A desire to capture my thoughts and experiences right here, on the Internet.

Perhaps you’re wondering, “So what are you going to talk about in your blog, Hong?”

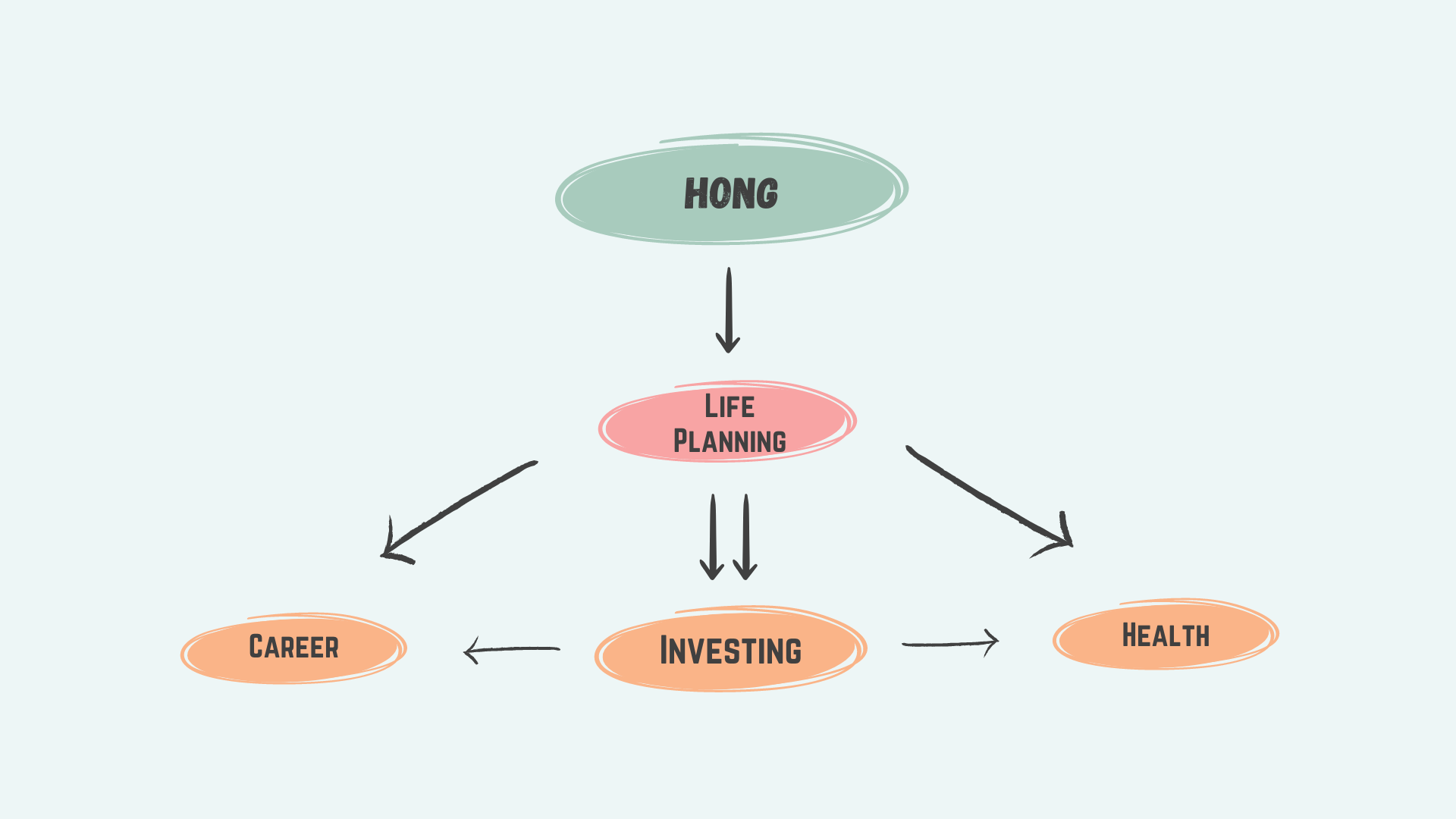

I am going to delve into the things that I find incredibly interesting to me. I hope that what interests me will interest you. Here is a simple mind map outlining the topics that I am eager to explore in my blog.

A pretty straightforward mind map, right? As you see, I am heavily invested in my life. I am the architect who plans how my life will turn out, and I am also the executor of the plan. It is ideal when a plan is executed as it is intended, but I have come to realize that is not always the case. Life often throws insane curve balls at you, unexpectedly. So, it is my responsibility to be prepared to hit those curve balls. Planning my life carefully will heighten the likelihood of scoring a home run. As I set my sights on hitting this home run, I am preparing to excel in the three crucial dimensions: Investing, Career, and Health.

Investing forms the overarching theme in my current life. It means investing not only in the financial markets, but also in my career and health. I invest a big chunk of my life in learning how to get better in these three domains. With this foundation laid, I want to start this blog by recounting my journey in how I became interested in investing in the financial markets and how it led me to reflect more earnestly on career development and personal well-being. To illustrate how I started investing in the financial markets, I must first touch on my post-college life.

Having completed my bachelor’s in chemical engineering at UCLA in 2019, I got a job as a validation engineer at an engineering consulting firm in the pharmaceutical sector. Reality of being an engineer was quite different from what I had imagined at school while I was tackling rigorous engineering courses. My initial vision involved making six figures right out of college and living a stable life with no burdens. But guess what? I wasn’t making six figures. I was making $60,000, a far cry from that ideal. I then questioned myself. How am I going to make six figures? When am I gonna be financially independent?

At that time after graduating college, I was paying around $2000 for my rent. It was not fun at all. Witnessing more than half of my monthly paycheck evaporate on the first day of each the month was quite unpleasant, to say the least. Then I thought that there had to be a better way to financial independence than the conventional 9-to-5 corporate grind. This thought was innate to me, as I never liked being complacent (and I still don’t). Fortuitously, thanks to my father, I had $10,000 in my bank account that I could use to buy some “stocks” (note the quotes as, initially, this was purely speculative rather than investing). I had no idea what stocks were, but just like many others at that time, I downloaded Robinhood and bought some stocks that interested me. A few shares of AMAT, AMD, MU, and ON – semiconductor companies familiar from my studies (I studied semiconductor manufacturing as a chemical engineering major in college) – were now in my black and green Robinhood app. With some money in those stocks, I bought some best-selling finance books on Amazon to gather investing insights (at the time, I was actually looking for some systematic and methodical ways to make money – in other words, formulas).

This, by far, was the most pivotal moment in my life. One of the books that I purchased was The Intelligent Investor by Benjamin Graham. I meticulously read this book, underlining so many sentences in each chapter and using tons of sticky notes to earmark chapters for later reference. This book gave me an entirely new perspective on how I should approach investing. In its wake, I wanted to be like Ben Graham and Warren Buffett. I wanted to grow my $10,000 and become financially independent. From then on, I was launched into the world of investing. I read books on investing, I took a course in Value Investing, I studied for the CFA exam, and I immersed myself in podcasts on investing. And so on. Currently, I am preparing for the GMAT exam as I’ve decided that I want to learn to invest more professionally through a well-versed MBA program.

Since my graduation, my understanding of investing has expanded significantly, but objectively speaking, what I know now about investing is a mere speck compared to the towering expertise of the world’s foremost investors. This humility coexists with my motivation to learn more. Hence, here I am, investing my time and effort to enrich my insights.

In this blog, I aim to chronicle my journey of self-improvement, using investment principles and the wisdom of accomplished businessmen and investors to enrich my daily life.

Hope you enjoy it as much as I do.